Compliance and Risk Management

Status of Compliance and Risk Management System

Basic approach

The Tokai Tokyo Financial Group considers compliance to be one of its most important managerial tasks, and it has put in place a system for ensuring the propriety of operations. The Group has established and enforces basic standards such as the Basic Compliance Policy and the Ethical Code of Conduct.

We have a risk management framework as described below: As per the Risk Management Rules, the Group has defined the departments responsible for each risk category, and it comprehensively manages the overall risk of the Company and subsidiaries. It has also established the Comprehensive Risk Management Committee as the Company's organization for deliberations and planning concerning risk management policy and matters deemed necessary for management methods formulation and risk management practices. The results and proposals are reported and submitted to the Board of Directors.

Based on the Compliance Program, which is an annual compliance practice plan for employees, compliance study sessions and confirmation tests are held regularly to ensure effectiveness. In the unlikely event of a problem, such as a breach of the law or misconduct, it is promptly communicated to management, and an organizational system is built and maintained to deal with it appropriately.

Compliance framework

As a framework for securing the effectiveness of measures to enforce the strict observance of laws and regulations, the Group has set up the Comprehensive Risk Management Committee as an organization to offer opinions about the measures to be taken, and it has established the Comprehensive Risk Management Department as the department specialized in providing guidance, monitoring, and coordination on compliance. The Group also has the Anti-Money Laundering Department, which coordinates and enhances groupwide efforts to ensure that preventive measures against money laundering or the funding of terrorism are working effectively and are fit for purpose.

Risk management framework

In accordance with the “Basic Risk Management Policy” and the “Risk Management Rules,” the Group has defined the departments responsible for each risk category, and it comprehensively manages the risk of the Company and its Group companies. It has also established the Comprehensive Risk Management Committee as the organization for deliberations and planning concerning risk management policy, risk management method, and other matters deemed necessary for risk management. The results and proposals are reported and submitted to the Board of Directors.

In addition, as a crisis management framework for disaster situations, etc., the Group has clarified responsibilities under the “Basic Policy of Crisis Management (Disaster, etc.)” and the “Crisis Management Guidelines for Disasters, Etc.” for the purpose of enhancing a comprehensive and systematic disaster prevention, emergency response, and recovery. The Group established Comprehensive Risk Management Department that specializes in supervising, guiding and monitoring the preventive schemes and activities associated with these various risks.

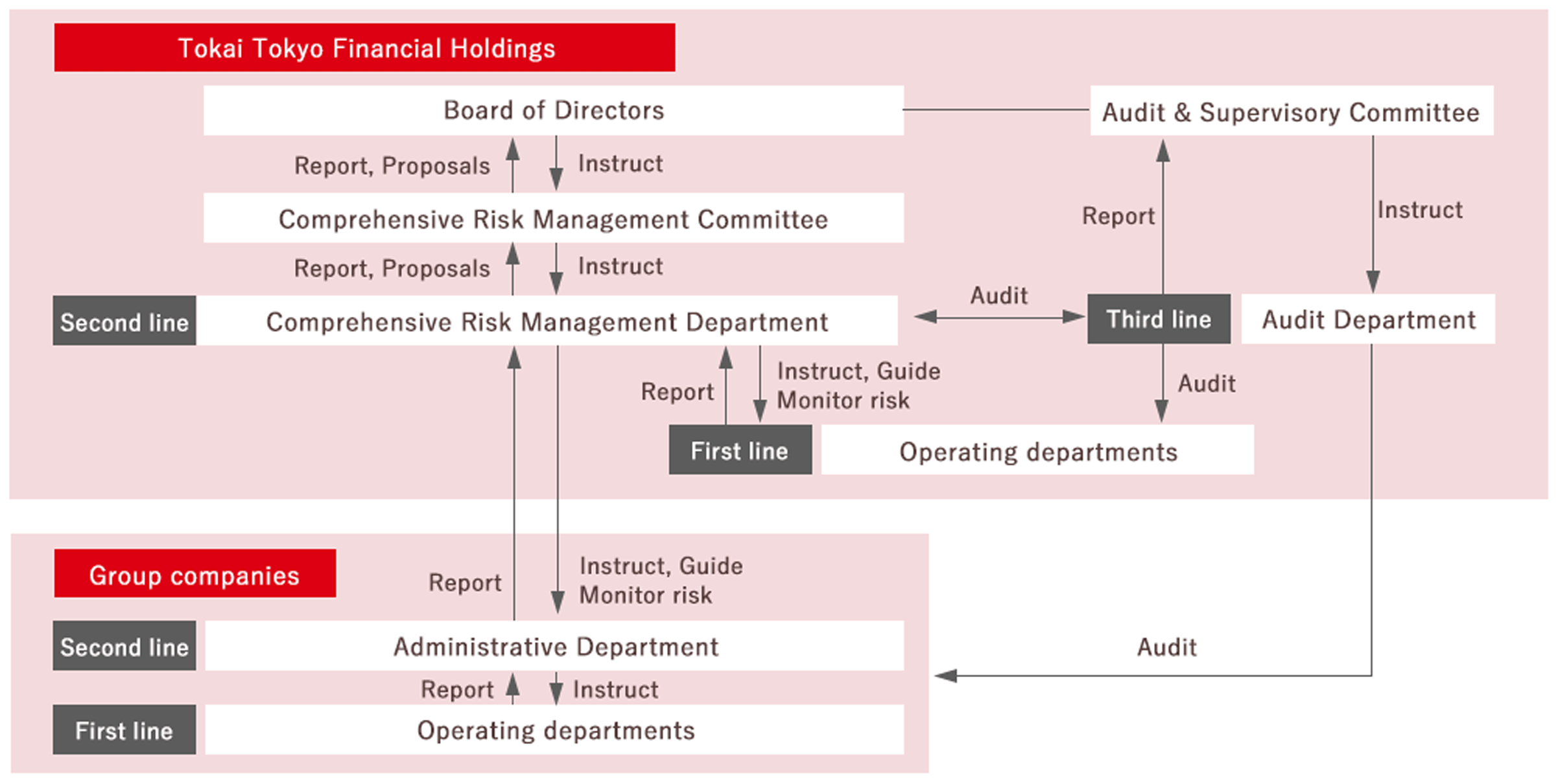

Three lines of defense for risk management

The Company as a group constantly seeks to fortify its risk management system and employ a “three lines of defense” approach of risk identification, assessment, and monitoring.

Operating departments

These departments have before-the-fact and after-the-fact responsibilities for identifying, assessing, and managing risks.

Through risk assessments and compliance study sessions, they take the initiative in recognizing (identifying and assessing) various types of risks in operations.

Comprehensive Risk Management Department / Administrative department of subsidiaries

This department supports the risk management of the first line.

Maintaining close communications with the operating departments, it ensures that risks are properly identified and managed.

Audit Department

This department verifies and assesses from an independent perspective whether the first and second lines of defense are functioning effectively.

It evaluates the effectiveness of internal control processes related to financial reporting.

Risk Management System of Tokai Tokyo Securities

Tokai Tokyo Securities has established the Market and Credit Risk Committee and the Administration and Finance Committee, as well as related regulations, and has put in place a system whereby each risk is managed, analyzed and reported by a department that is systematically independent from trading operations and sales departments. From the perspective of ensuring management and financial soundness, the Board of Directors has set a minimum capital adequacy ratio target to be maintained, and the maintenance of this target is the basic policy for risk management operations.

| Risk Category | Measures |

|---|---|

| Market Risk Management |

In addition to measuring the amount equivalent to market risk in the measurement of capital adequacy ratios, the risk management department calculates the amount of risk, profit and loss on a daily basis and reports on compliance with risk limits and loss limits in accordance with the Regulations on Risk Management and the Regulations on Market Risk Management. |

| Credit Risk Management |

In addition to measuring the amount equivalent to counterparty risk in the measurement of capital adequacy ratios, the risk management department, in accordance with the Regulations on Risk Management and the Regulations on Market Risk Management, examines the financial position of each counterparty and the details of each transaction and sets risk limits for each counterparty, monitors daily compliance with these limits and reports on the status of compliance with risk limits. |

| Liquidity Risk Management Associated with Funding |

Based on the “Liquidity Risk Management Rules,” the departments responsible for financing monitor and manage suitably the cash position on a daily basis. Moreover, they prepare a contingency plan to deal with financial market volatility, and they present a monthly funding forecast periodically to the Finance & Accounting Committee. |

Publication of integrated reports

Details of the Group's compliance and risk management systems are described in the Integrated Report.

In issuing the Integrated Report, the Group refers to the International Integrated Reporting Framework proposed by the IIRC (International Integrated Reporting Council).

Cutting off relations with anti-social forces

Tokai Tokyo Financial Group’s Ethical Code of Conduct stipulates that the Company will take a firm stand against antisocial forces that threaten the order and safety of civil society. In addition, the “Rules on Cutting Off Relations with Anti-social Forces” set forth specific procedures for cutting off relationships with anti-social forces, including the verification of whether a person who enters into a contract with the Company for the first time and existing contractors and business partners, etc., fall under anti-social forces.

Prevention of Corruption and Bribery

Tokai Tokyo Financial Group’s Ethical Code of Conduct stipulates that we shall not engage in any form of corrupt practices, including bribery and/or accepting bribes (business entertainment and giving or receiving of gifts that are not socially acceptable, collusion, embezzlement, and breach of trust).

The contents of the Group’s Ethical Code of Conduct are thoroughly communicated to managers and employees through compliance study meetings and confirmation tests. In addition, various measures are discussed and promoted in the Comprehensive Risk Management Committee, and the status is regularly reported to the Board of Directors.

Anti-Money Laundering and Anti-Terrorist Financing

The Group has established the Regulations on Anti-Money Laundering and Anti-Terrorist Financing in the TTFG, taking into consideration the possibility that funds transacted through the Group may be used for various crimes and terrorism.

Group Compliance Hotline System (Establishment of a reporting and consultation service)

The Group has established the Group Compliance Hotline System as a reporting and consultation service for all types of misconduct, including those specified in the Basic Compliance Policy and the Ethical Code of Conduct. Under this system, in addition to the Reporting and Consultation Office, where employees can consult if they do not know where to go for advice, the TTFH Internal Reporting Desk and the External Reporting Desk have been established. The system is made known to managers and employees through posting on the in-house intranet, compliance study meetings, and confirmation tests. In addition, the Regulations on Group Whistleblowing and other regulations stipulate that anonymous reporting is also possible, and that no disadvantageous or unequal treatment shall be given to a whistleblower for the reason that he/she has made a report.

Business Risks

The following is a list of the principal risks that management recognizes as having the potential to materially affect the Group's financial position, results of operations and cash flows, among other matters relating to business and accounting conditions described in the Securities Report. Risks that have not been identified at the present time or are not currently considered significant may also have a significant impact on the Group's operating results and financial position. The forward-looking statements in the text are based on the Group's judgment as at the end of the current financial year.

⑴ Risk related to economic and market trends

The financial instruments business, which is the Group's principal business, is susceptible to fluctuations in stock prices, interest rates and foreign exchange markets, as well as to economic conditions in Japan and overseas, such as economic recession. The financial position and results of operations of the Group may be adversely affected by reduced fee income and fluctuations in trading profits and losses due to reduced investment demand.

In addition, the Group holds a large number of securities to meet the diverse needs of its customers, but if the value of financial assets fluctuates due to sudden changes in market conditions or interest rates due to market turmoil or other factors, or if the Group is forced to trade at prices that are significantly less favorable than normal, its financial position and results of operations could be adversely affected.

⑵ Regulatory risk

With regard to the risks associated with regulatory requirements, the financial instruments business, which is the Group's principal business, is regulated by laws, regulations and rules depending on the type of business. Financial instruments firms in Japan are regulated by the Financial Instruments and Exchange Act and related ministerial ordinances regarding registration regulations, customer solicitation regulations, customer transaction regulations, proprietary trading regulations and other regulations governing their conduct as financial instruments firms, and in the unlikely event of a breach, they may be subject to administrative action, including suspension of business.

In addition, Type I financial instruments operators, including Tokai Tokyo Securities Co., Ltd. are required by these laws and regulations to maintain a prescribed capital adequacy ratio, and in the unlikely event that the capital adequacy ratio falls below the prescribed level, the Group may be ordered to suspend operations, which could have an adverse effect on its financial position and business performance.

⑶ Competition risk

With regard to the risks associated with the competitive situation, the financial instruments business, the Group's main business, has become increasingly competitive due to significant deregulation in recent years, while at the same time the products handled have become more diversified. Under these circumstances, if the Group is unable to maintain the same level of competitiveness as before due to the emergence of stronger competitors in the future, the Group's financial position and results of operations may be adversely affected.

⑷ Credit risk (involving clients or issuing entities)

With regard to the risks associated with deterioration in the creditworthiness of counterparties or issuers, since the Group holds financial assets on its own account as well as shares and other securities for the purpose of maintaining and building alliances and friendly relationships with its counterparties and meeting the diverse needs of its customers, the Group is exposed to the risk that its counterparties may default on their obligations, including settlements, or if the issuers of the securities held by the Group suffer a significant deterioration in their credit conditions, the financial position and results of operations of the Group may be adversely affected by losses due to damage to the principal or delays in interest payments.

⑸ The risk associated with fund procurement for our day-to-day operation

With regard to the risks associated with deterioration in the financing environment, the financial instruments business, which is the Group's principal business, requires a large amount of funds to hold a large number of securities due to the nature of the business, and it is necessary to ensure adequate liquidity and maintain financial security. However, in the event of a drastic change in market conditions such as a credit crunch, a decline in banks' lending capacity, a deterioration in the credit ratings of the Company and Tokai Tokyo Securities Co., Ltd., or uncertainty over the performance of the Group, the Group may be forced to raise funds at significantly higher interest rates than usual to secure necessary funds. This may adversely affect the Group' s financial position and business results.

⑹ System risk

As computer systems are essential equipment for the financial instruments business, which is the Group's main business, in the event of a failure of the computer systems and lines used during business due to a program failure, unauthorized external access, disaster or power failure, etc., the Group's financial position and results of operations may be adversely affected. Depending on the scale of the failure, not only could the Group's operations be disrupted, but the Group's financial position and business performance could also be adversely affected due to a decline in transactions because of a loss of public trust.

⑺ Operational risk

With regard to the operational risks, the Group's diverse operations generate an enormous amount of paperwork daily, and the Group's financial position and results of operations could be adversely affected if officers and employees fail to carry out accurate paperwork, or if losses occur due to errors, accidents or irregularities in office administration or paperwork. This could have a negative impact on the Group's financial position and results of operations. In addition, the Group's financial position and results of operations may be adversely affected by the possibility of administrative sanctions, such as suspension of business operations, being imposed by the supervisory authorities in the event of legal violations, resulting in a decline in public trust in the Group.

⑻ Data security risk

With regard to the information security risks, since the Group holds personal information of many customers and other parties, important business information of business partners and other parties, and the Group's own important information, in the event of a breach of personal information of customers or other parties or the Group's own important information, not only could the Group's operations be disrupted, but it could also have an adverse effect on the Group's financial position and results of operations, such as a decrease in transactions due to claims for damages or loss of public trust.

⑼ Disaster risk

Regarding risks related to disasters, etc., the Group's main subsidiary, Tokai Tokyo Securities Co., Ltd. could have a negative impact on the Group's financial position and results of operations in the event of a disaster or other event that seriously affects the lives of citizens and infrastructure in the Tokai and Kanto regions where Tokai Tokyo Securities Co., Ltd. mainly operates. In addition, since many officers and employees are engaged in operations at the Group's bases of operations in Japan and abroad, if a large-scale natural disaster such as an earthquake or typhoon, power outages or other disruptions caused by such events, or the spread of pathogenic infectious diseases occurs, the Group may be forced to scale down its operations, which could have a negative impact on its financial position and performance.

⑽ Litigation risk

With regard to the risks related to litigation, since the Group enters various transactions on a daily basis in Japan and overseas, in the event of differences in mutual understanding based on laws and regulations, business practices, contracts and terms and conditions, etc., lawsuits for damages may arise with business partners, which may adversely affect the financial position and results of operations of the Group.

⑾ Human resources availability risk

With regard to the risks related to securing human resources, despite of the fact that the Group is engaging in operations requiring a high level of expertise, mainly in the financial instruments business, and is working to secure competent personnel, due to the fierce competition to secure talented personnel, the resultant difficulties in securing the necessary personnel could have an adverse effect on the Group's financial position and results of operations.

⑿ Overseas business risk

With regard to the risks associated with overseas operations, since the Group is actively expanding overseas by establishing local subsidiaries and forming alliances with leading overseas brokerage groups and other entities, if infringement of local laws, regulations, business practices, etc. happens, the Group's financial position and results of operations could be adversely affected due to suspension, interruption, downsizing or delay of business development or a decline in public trust in the Group.

⒀ Reputation risk

With regard to the risks related to rumors, since the Group relies heavily on the trust of its customers and business partners, if the Group is exposed to the spread of rumors and rumors that are speculative or not necessarily based on accurate facts, the Group's financial position and results of operations may be adversely affected by the occurrence of reputational damage that reduces the Group's social credibility, even though the content of such rumors is not accurate.

⒁ Risk Management Policy and the infrastructure for risk management

With regard to the reduction of the risks related to the Regulations on Risk Management and systems, the Group has designated a department responsible for each risk category and manages the risks of the Company and its subsidiaries as a whole in an integrated manner, but unexpected market fluctuations, errors or obsolescence of data for risk management, changes in the nature of business or amendments to laws and regulations, etc. may cause the Group's risk management system to fail to function effectively. If losses or damages result, the financial position and performance of the Group may be adversely affected.

⒂ Risk related to business expansion

The Group has sought to expand its business through acquisitions and capital alliances with a view to expanding the Group's customer base and expanding its business base utilizing DX capabilities, taking business expansion into account. Successful acquisitions and capital tie-ups require, among other things, the efficient integration of businesses. There is a possibility that the acquired or capital-allied businesses may not generate the revenues that the Group anticipated. If the Group's initial expectations are not met, or if significant unforeseen problems are discovered after the acquisition or capital alliance, the Group's financial position and results of operations may be adversely affected.

⒃ Risks related to climate change, etc.

In light of the recent increase in damage caused by extreme weather events and natural disasters around the world, the Group is strengthening information disclosure based on TCFD recommendations to better understand the impact of climate change on the Group. The Group will also promote initiatives to contribute to the realization of a decarbonized society. Climate change risks include risks arising from climate change, such as direct damage to assets and indirect impacts from supply chain disruptions (physical risks), as well as financial and reputational risks arising from the transition to a decarbonized society due to far-reaching policy and regulatory changes to tackle climate change issues (transition risks), which, if they occur, depending on their nature and speed, could have an adverse impact on the Group's financial position and results of operations.