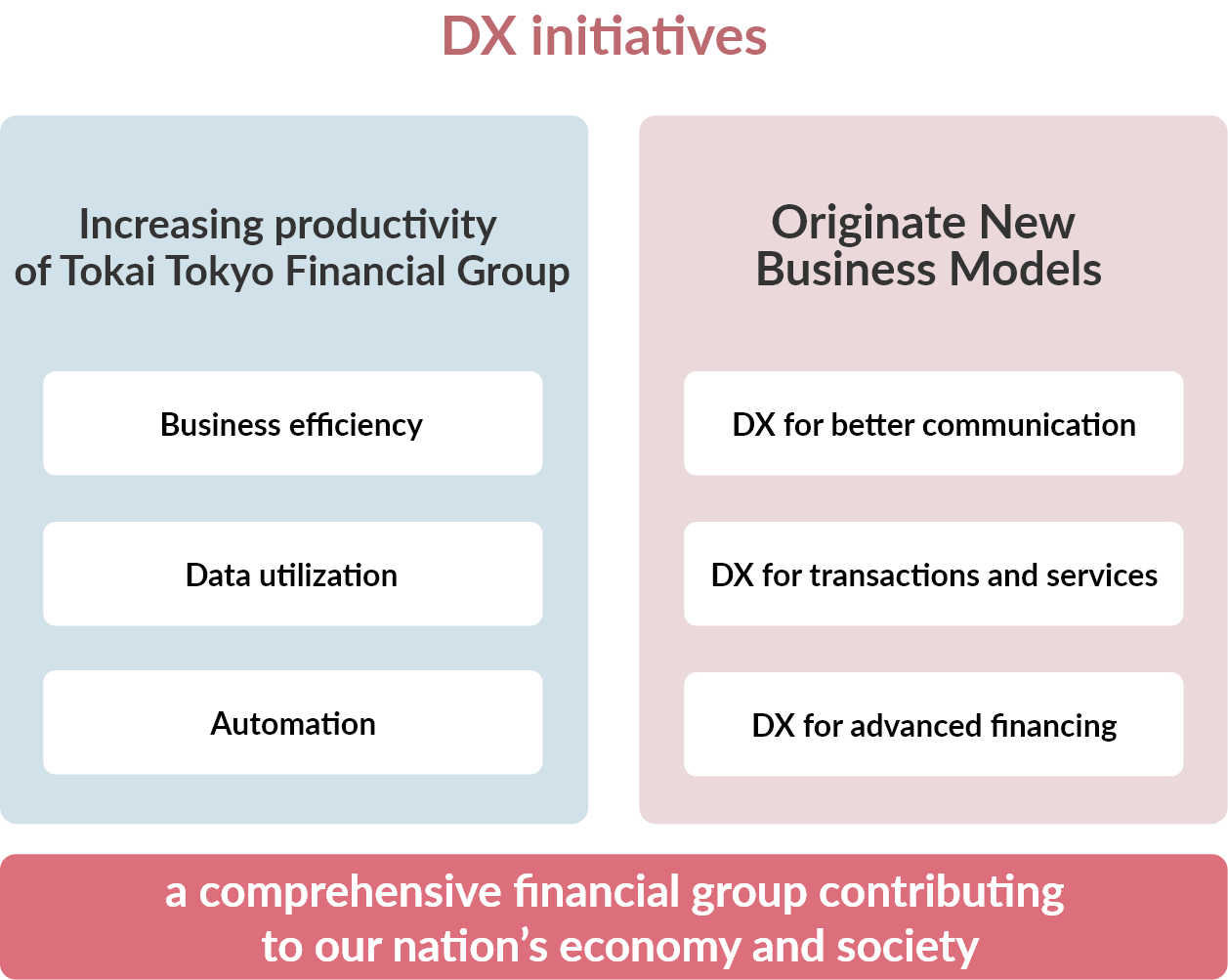

Of the mentioned strategies above, we consider that digitalization should be one critically important task to be taken on. Such a view is based on our perception of the current changes in the business environment, and they are rapidly permeating digitalization, fast FinTech evolution and its subsequently expanding application fields, new entrants into the financial industry from the non-financial sector, and workstyle changes induced by corona pandemic. All these changes in operational circumstances call for digital transformation for us to maintain sustainable growth for the sake of our better adaptation and survival. Thus, we will grapple proactively with digital transformation.

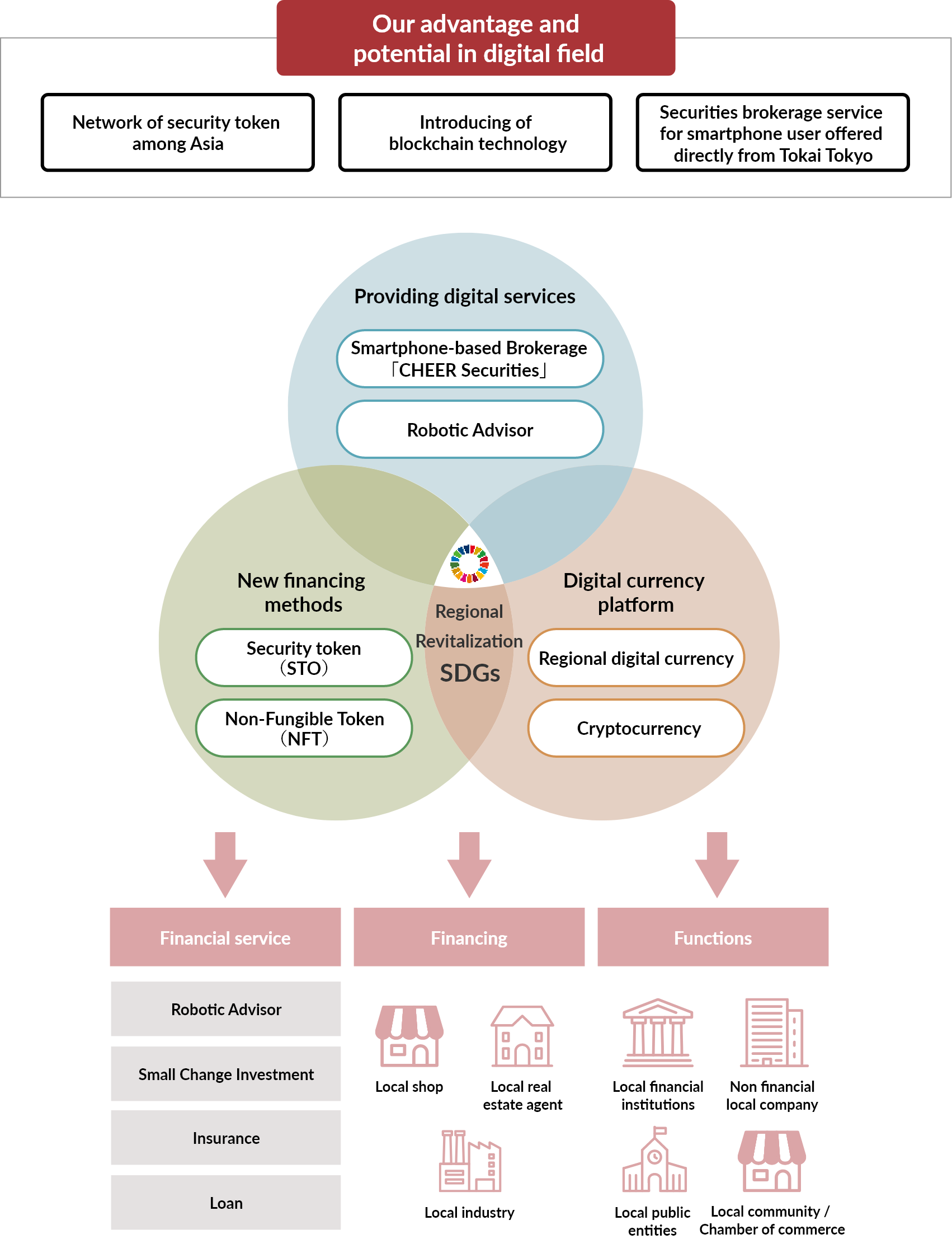

We, Tokai Tokyo Financial Group, aspire to reconfigure our business up to a next-generation securities brokerage operation which is dubbed “Securities DX3.0”. Toward this end, we use AI-driven database marketing, diagnosis-based inheritance simulation analysis, and asset management performance evaluation tools for better customer service, as well as implement work process reform. Further, we keep honing the services in digital arenas such as the one for smartphone users, and others associated with digital currencies trading and blockchain technology and sharing those with an expanded range of alliance partners. As such, we will contribute to the nation’s economy and society by growing ourselves as a distinctive securities brokerage firm carrying full-line services and products that set us apart from the competitors.