Strategy

Recognition of risks and opportunities

Climate change related risks include risks arising from climate change (physical risks), such as direct damage to the assets and indirect impacts resulting from supply chain disruptions, and financial and reputation risks (transition risks) caused by wide-ranging policy and regulatory changes to address climate change related issues in preparation for the transition to a carbon-free society. The Company recognizes that the occurrence of these risks, depending on their nature and speed, may have a negative impact on the Group's financial position and business performance.

| |

|

Risk |

Opportunity Benefit |

Risk to be

Triggered

by Changes |

Policy and

Regulatory

Changes |

- We may suffer the increased cost of operation if the government tightens CO2 emission reduction requirements or the related regulatory constraints.

|

- Cut the energy cost by installing energy-saving equipment.

- Expand the scope of operation by taking on new business opportunities like a green investment. We pursue such a new business opportunity by taking advantage of our solid geographical market in Chubu and unique alliance strategy implemented with strong regional banks.

|

Impact

on Market |

- Due to market fluctuations caused by the sudden transition to decarbonizing society, we may incur losses from our trading operation.

|

- We expect to see the increased customer inflow to stocks, bonds, and the investment fund with the underlying asset of stocks or bonds issued by the firms aggressively coping with climate change. Also, we expect to see an appreciation of the fund betting on society’s decarbonization trend. We can grow the assets under custody facing the impacted market.

|

| Technology |

- We may lose earning opportunities if we cannot differentiate ourselves from our peers or offer products and services that suit changing industrial structure and customer needs to be prompted by decarbonization technology advancement.

|

- The refined competence of financial product development and enhanced sales capability should enable us to deliver adequately the products and services suitable to customer needs arising from climate change. At the same time, the individual and corporate customers to be awakened to the decarbonizing society would find it meaningful to invest in climate change-related financial products. Thus, we would recognize the decarbonization trend as a viable opportunity.

|

| Reputation |

- Our reputation may be ruined if we fail to meet the stakeholders’ rising expectations for our climate change actions and related disclosures.

|

- We would be able to win a desirable corporate reputation by supporting the companies engaging in low-environmental loading businesses or the operations for the environmental loading reduction.

|

Physical Risk

to be Triggered

by Natural Disaster |

|

- Massive typhoons, heavy rainfalls of disaster magnitude, and other natural disasters attributable to abnormal weather may deteriorate our business as it may; cause damage to properties of both our clients and the Company, disrupt our daily operation due to the employees who suffer injuries, accrue the cost to cope with the resulting situations and worsen our financial performance.

|

|

Scenario Analysis

From the scenarios publicized by Network for Greening the Financial System, we chose the three of them and conducted quantitative and qualitative analyses and assessments of the impact on the Group’s financial standing (expenses and earnings) under respective hypothesis; 1) “Orderly - Net Zero 2050”, the minimum transition risk and physical risk; 2) “Disorderly - Divergent Net Zero”, the maximum transition risk; and 3) “Hot house world - Current Policies, the maximum physical risk.

Overall, we understood that the impact on the Group’s financial standing was limited. At the same time, however, we reconfirmed the importance of creating business opportunities and promoting measures without failing to take advantage of the expanding investment needs in the green sector in the future.

We will continue to improve the level of analysis.

Scenario Analysis Overview

| Scenario assumptions |

Network for Greening the Financial System

- Orderly - Net Zero 2050

- Disorderly - Divergent Net Zero

- Hot house world - Current Policies

|

| Analysis period |

As of 2050 |

| Analysis method |

Quantitative and qualitative analysis of impact on financial standing (expenses and earnings), and assessment of the degree of impact |

| Analysis results |

Limited impact on the Group's financial standing |

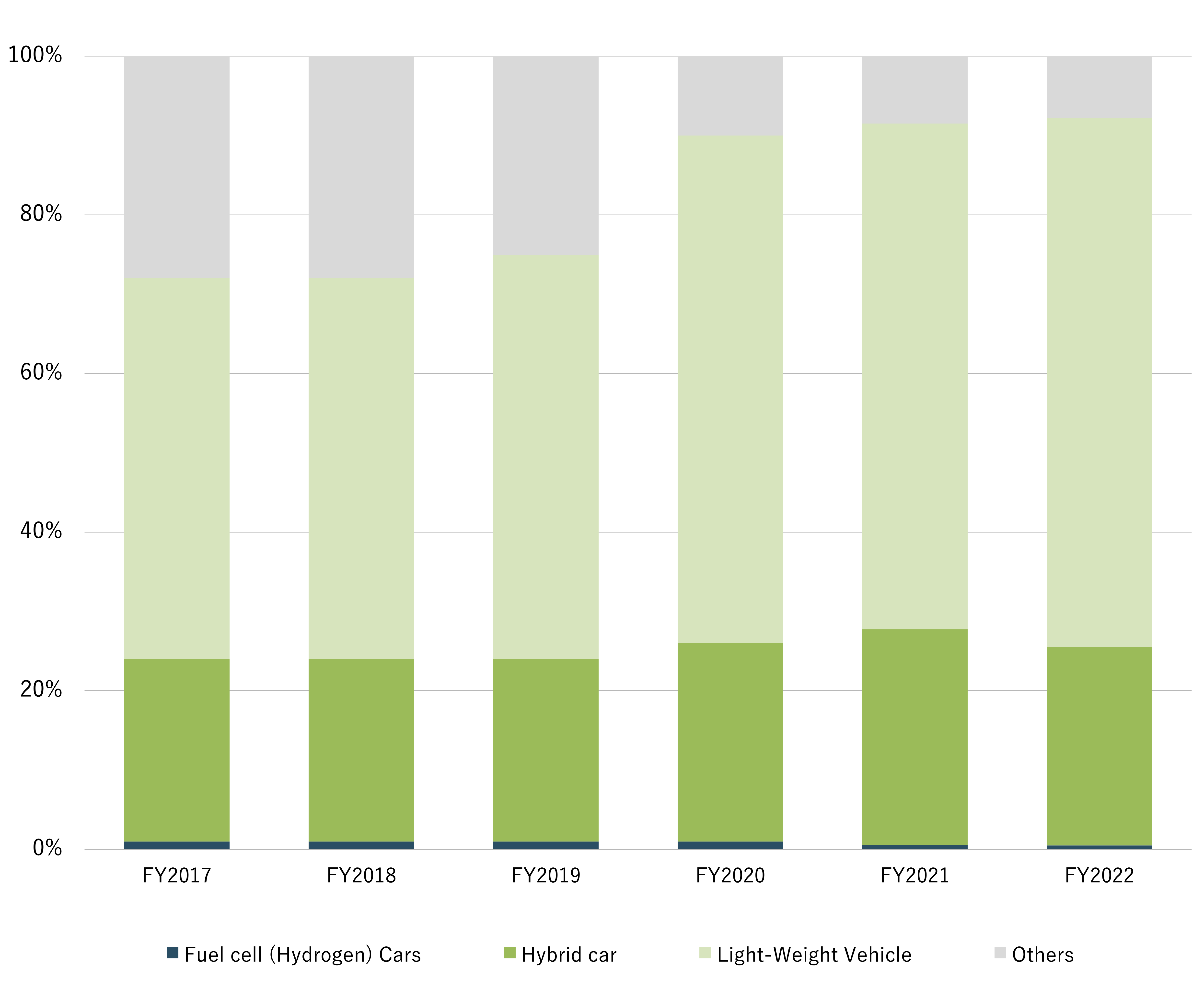

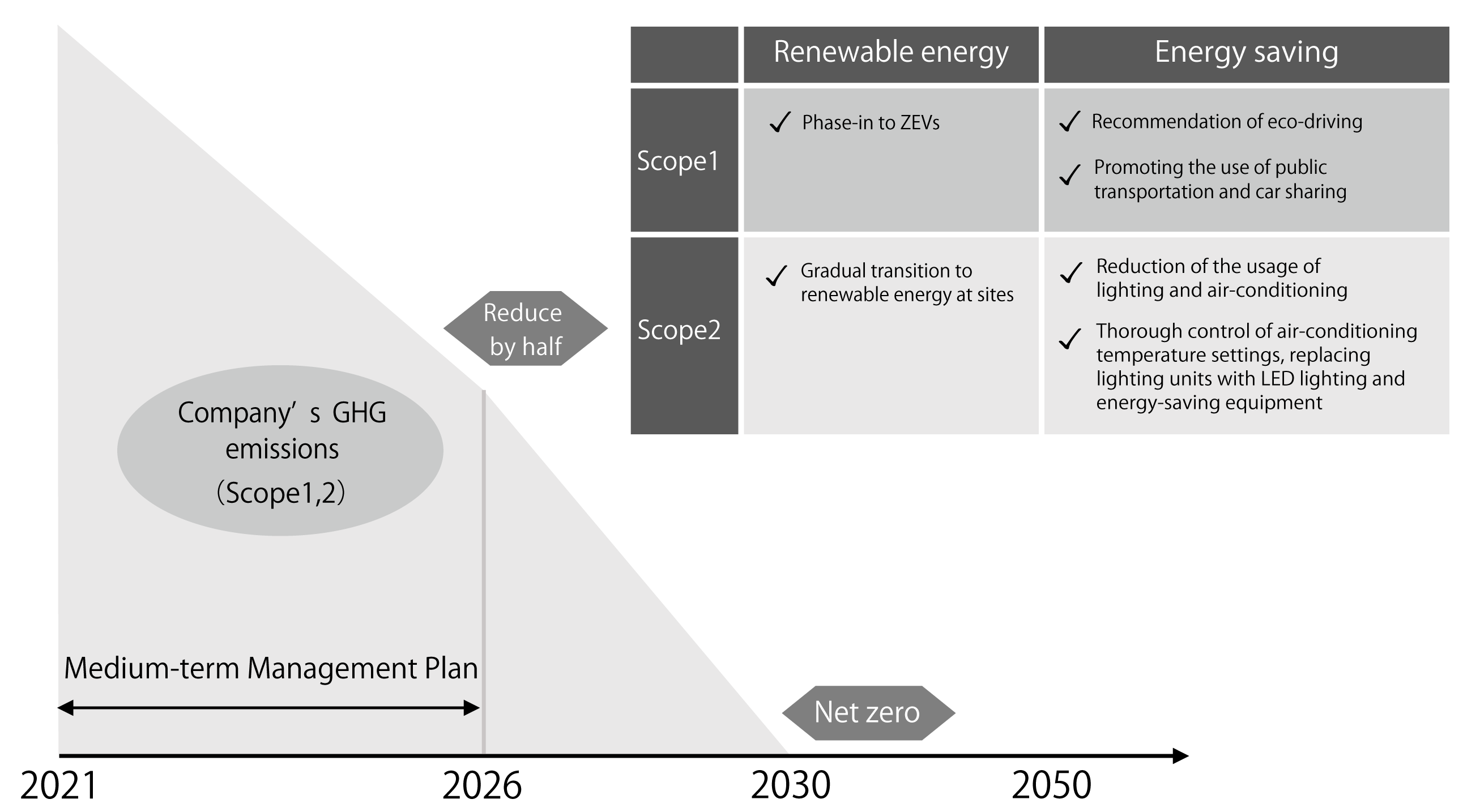

Transition Plan (Road map for early realization of carbon-free society)

As part of the medium-term management plan “Beyond Our Limits” launched in April 2022, the Group has established “Social Value & Justice” KPIs, including the goal of reducing CO2 emissions associated with our own operations to half (compared to fiscal 2021 actual results) by March 2027 and to net zero by 2030. In addition to the above targets, in December 2022 we formulated the Net Zero Declaration on Greenhouse Gas Emissions, which includes our endorsement of the Paris Agreement adopted in December 2015 and the 2050 Carbon Neutrality Declaration announced by the Japanese Government in October 2020, as well as our contribution to the realization of a carbon-free society through our operations that fulfill the role as a financial service provider. The transition plan will be reviewed as appropriate based on the TCFD and other frameworks, and the Company will promote measures toward the early realization of a carbon-free society.