Basic approach to the internal control system and the status of its development

In accordance with the Companies Act and the Ordinance for Enforcement of the Companies Act, the Company has established the following basic policy on the development of systems to ensure the proper conduct of the Company’s business (hereinafter referred to as the “internal control system”).

System to ensure the appropriateness of operations in the Tokai Tokyo Financial Group

The Company shall develop and operate the systems necessary to ensure the appropriateness of the Group’s operations.

- ⑴ As the holding company overseeing the business of the Group, the Company shall establish a basic policy on the management of Group companies and develop a management system for Group companies by establishing a reporting system to the Board of Directors, etc.

- ⑵ In order to ensure a sound internal control system as a group, the Company and its subsidiaries shall establish a management philosophy, Group Code of Ethical Conduct and Group Compliance Basic Policy, shall disseminate these and other principles to group companies and shall ensure that directors and employees of the Company and its subsidiaries comply with laws, regulations, and other rules.

- ⑶ In accordance with the Regulations for Management of Affiliated Companies and Regulations on Risk Management, the Company shall implement controls such as requesting reports from subsidiaries on their management details and risk management status and provide management guidance and guidance on the development of risk management systems as necessary.

- ⑷ In accordance with the Regulations for Management of Affiliated Companies and the Regulations on Internal Audit, audits of subsidiaries are conducted by the Audit Department, the results of which are reported to the Audit & Supervisory Committee, which in turn reports them to the Board of Directors.

- ⑸ In accordance with the Regulations for Management of Affiliated Companies, when a subsidiary intends to decide on an important management matter, the subsidiary shall be requested to submit the decision in advance and, if necessary, prior approval shall be given. In addition, to understand their financial position, they shall report their financial results to the Board of Directors on a quarterly basis.

- ⑹ In order to ensure the adequacy and reliability of financial reporting, basic rules on internal control over financial reporting shall be established, and the necessary systems shall be built, maintained, and operated appropriately. The President and Representative Director shall carry out a final assessment of the effectiveness of the maintenance and operation of internal control over financial reporting about the Group and report the results of this assessment to the Board of Directors.

Systems to ensure that the execution of duties by directors and employees complies with laws, regulations, and the Articles of Incorporation

The Company shall develop and operate the systems necessary to ensure that the execution of the duties of the directors, executive officers and employees of the Company and its subsidiaries complies with laws, regulations, and rules.

- ⑴ The Board of Directors shall consist of directors who are members of the Audit & Supervisory Committee and other directors (“executive directors” and “non-executive directors”) and their respective roles shall be clearly defined.

- ⑵ The Board of Directors shall establish basic norms, such as the Group Compliance Policy and the Group Code of Ethical Conduct, as a system for compliance with laws, regulations and rules by the directors and employees of the Company and its subsidiaries and shall strive to implement these.

- ⑶ In order to ensure the effectiveness of compliance with laws, regulations and other rules, the Board of Directors shall establish the Comprehensive Risk Management Committee as an organization to report on measures to establish a Group compliance system, and the Comprehensive Risk Compliance Department as a specialized department to oversee, guide and monitor Group compliance. The status of the Group’s compliance is ascertained by the Comprehensive Risk Compliance Department, which reports to the Comprehensive Risk Management Committee, which in turn reports to the Board of Directors.

- ⑷ The Audit & Supervisory Committee checks the status of business execution through internal audits. The Audit Department conducts internal audits and reports the results and other information to the Audit & Supervisory Committee. The Audit & Supervisory Committee reports the results and other matters to the Board of Directors.

- ⑸ An internal reporting system (Group Compliance Hotline) shall be established for the purpose of deterrence, early detection and correction of illegal and inappropriate acts, and efforts shall be made to ensure its effectiveness.

- ⑹ The Group shall take a resolute attitude towards forces and organizations that engage in anti-social activities and shall establish a system to ensure that it does not conduct any business with them.

- ⑺ The Group shall endeavor to prevent money laundering, eyeing activities that funds transacted through the Group may be used for various crimes and terrorism.

Systems to ensure the effectiveness of the Board of Directors

The Company shall develop and operate the necessary systems to ensure the effectiveness of the Board of Directors.

- ⑴ The Board of Directors shall comprise a diverse range of directors with different backgrounds in terms of expertise and experience, to ensure the effective and efficient performance of its functions. It shall also endeavor to ensure diversity in terms of gender and internationality.

- ⑵ The Board of Directors shall strive to create an environment that supports appropriate risk-taking by senior management. It also endeavors to ensure the diversity of the Board of Directors as it should be, considering the strategic stage of the company and avoiding the fixation of directors.

- ⑶ The Nomination and Remuneration Committee shall be established as an advisory body to the Board of Directors of the Company to ensure objectivity and transparency in the decision-making process about the nomination (including reappointment) and dismissal of directors.

- ⑷ The Board of Directors decides on the content of proposals for the nomination and dismissal of directors to be submitted to the General Meeting of Shareholders in accordance with the relevant laws and regulations, after receiving a report from the Nomination and Remuneration Committee following deliberations based on the criteria for the election of director candidates.

- ⑸ The Board of Directors analyses and evaluates the Board of Directors to improve its effectiveness.

Systems to ensure the efficient execution of the duties of the directors

The Company shall establish and operate the necessary systems to ensure that the Directors’ duties are performed efficiently.

- ⑴ In order to invigorate the discussions of the Board of Directors and speed up decision-making, the Board of Directors of the Company, in accordance with the Articles of Incorporation, delegates all or part of the decisions on the execution of business affairs, other than those exclusively determined by law, to the Chairman and the President and Representative Director.

- ⑵ In order to discuss the overall execution policy of the company’s business, a management committee consisting of the Chairman, the President and Representative Director and directors and executive officers appointed by agreement among them shall be set up.

- ⑶ The directors shall execute their duties properly and efficiently in accordance with the authority of duties and decision-making rules based on the Board of Directors Policies and the Executive Committee Policies.

System for the custody and management of information relating to the performance of duties by directors

In accordance with laws, regulations and various internal policies, information relating to the execution of duties by directors is held and managed together with related documents. The Audit & Supervisory Committee has access to such information.

Policies and other systems for managing the risk of loss

The Company shall establish and operate the systems necessary for the proper management of risks for the Group as a whole.

- ⑴ In order to prepare for various risks arising from the conduct of business, the Company shall manage the risks of the entire Group in an integrated manner by designating a responsible department for each risk category in accordance with the Regulations on Risk Management.

- ⑵ The Comprehensive Risk Management Committee shall be established to identify and manage the status of risk management for each responsible department and report the results regularly to the Board of Directors and the Audit & Supervisory Committee.

System, etc. concerning directors and employees to assist the duties of the Audit & Supervisory Committee

The Company shall establish and operate the necessary systems concerning directors and employees to assist the duties of the Audit & Supervisory Committee.

- ⑴ In order to increase the effectiveness of the Audit & Supervisory Committee, the Board of Directors shall establish the Audit & Supervisory Committee Office, which is independent of the operational executors, as an organization to assist the Audit & Supervisory Committee in its duties, and shall appoint directors and employees to assist the Audit & Supervisory Committee in its duties (hereinafter referred to as “Assistant Employees etc.”) with the consent of the Audit & Supervisory Committee.

- ⑵ The Audit & Supervisory Committee Office is independent of the operational executors and carries out its duties in accordance with the instructions and orders of the Audit & Supervisory Committee and reports the results of its work to the Audit & Supervisory Committee.

- ⑶ The Board of Directors shall respect the independence of the Audit & Supervisory Committee Office from the executives and endeavor to ensure the effectiveness of the instructions given to the Audit & Supervisory Committee’s assistant employees etc.

- ⑷ The personnel of the employees belonging to the Audit Department shall be determined in accordance with the opinion of the Audit & Supervisory Committee so that they do not hinder the proper performance of their duties.

System for reporting, etc. to the Audit & Supervisory Committee

The Company shall establish and operate the necessary systems for reporting to the Audit & Supervisory Committee.

- ⑴ Audit & Supervisory Committee members may attend meetings of the Management Committee, the Comprehensive Risk Management Committee, and other meetings, and may inspect the minutes of important meetings, records of decisions and other documents at any time.

- ⑵ The President and Representative Director shall report to the full-time Audit & Supervisory Committee Member or the Audit & Supervisory Committee in a timely manner on the status of reports from the internal reporting system (Group Compliance Hotline).

- ⑶ The Audit & Supervisory Committee may receive reports and request further reports from the accounting auditors, directors, employees, and other persons as necessary.

- ⑷ The Company shall not treat any director, employee or other person who reports to the Audit & Supervisory Committee in a disadvantageous manner on account of such report.

Other systems to ensure that the audit of the Audit & Supervisory Committee is carried out effectively

The Company shall establish and operate the necessary systems to ensure that the audits of the Audit & Supervisory Committee are carried out effectively.

- ⑴ The President and Representative Director, members of the Audit & Supervisory Committee and the Independent Auditor shall have regular opportunities to exchange opinions to promote mutual communication.

- ⑵ Opportunities are ensured for Audit & Supervisory Committee members to receive advice on audit work from legal and accounting experts.

- ⑶ Audit & Supervisory Committee members may receive advance payments or reimbursement from the company for expenses incurred in the performance of their duties.

Director remuneration

Our Nomination & Remuneration Committee helps ensure impartial and transparent decision-making in the nomination and remuneration of board members. The committee reviews director remuneration, including the policy on such remuneration, the formula for its calculation, and the levels of remuneration. In reviewing these matters, the members refer to remuneration levels in similar companies using an external database. The committee then reports its findings to the President & CEO, the Board of Directors and Audit & Supervisory Committee.

Director remuneration has two components: fixed and performance-linked components. The performance-linked component is further divided into bonuses and stock options. Bonuses provide a short-term incentive in that they reflect recent company performance. Stock options, on the other hand, reflect performance over the medium to long term.

The ratio of fixed to performance-linked remuneration is roughly 7 to 3. Outside directors and directors who serve on the Audit & Supervisory Committee receive only fixed remuneration.

How performance-linked remuneration is calculated

| Bonuses | Bonuses reflect consolidated performance in the short term as measured by return on equity. They also reflect the director’s individual performance and the performance of the Division he or she is responsible for. |

|---|---|

| Stock options | The value of stock options is linked to the Group’s performance over the medium to long term. As such, the directors will have a mutual interest with shareholders and be motivated to improve consolidated performance. |

Overview of director remuneration

| Rough breakdown of fixed and performance-linked remuneration |

Categories of performance-linked remuneration | |||

|---|---|---|---|---|

| Executive directors | Outside directors and directors who are members of the Audit & Supervisory Committee |

|||

| Fixed compensation | 70% | 100% | - | - |

| Performance-linked remuneration |

30% | 0% | Short-term incentive | Bonuses |

| Medium- to long-term incentive | Stock options | |||

Succession planning

We, the Company, have established a Succession Plan to ensure that our group grows sustainably while at the same time demonstrating our uniqueness widely.

Under the Succession Plan, we clarified the requirements that the next ideal leader must satisfy to assume the management responsibilities and began implementing the selection process. The process includes selecting the next leader candidates, training and evaluating such candidates, and finally deciding on the nomination.

Further, the Nomination and Remuneration Committee participates in the execution of the said process of the successor selection while it continuously monitors whether the selection process is appropriately followed as per the Succession Plan.

The nomination and dismissal process of directors

Nomination

We have established a set of standards for director candidates. Based on these standards, before nominating someone as a director (except a director who does not serve on the Audit & Supervisory Committee), the Board of Directors considers whether the candidate possesses the knowledge, experience, and sufficient social credibility necessary to execute the management of the Company effectively and impartially, and whether the person has the ability to advance the level of supervision of the Company’s operation. Before nominating someone as a director who is a member of the Audit & Supervisory Committee, the board considers whether the candidate possesses the knowledge, experience, and sufficient social credibility necessary to supervise the duty execution by a director who is not a member of the Audit & Supervisory Committee effectively and impartially.

Before nominating someone as an outside director candidate, the board considers, in addition to the above criteria, whether the person fulfills our independence criteria. Outside directors now account for the majority of board membership. Not only that, we retain the Nomination & Remuneration Committee to ensure impartiality and transparency in decision making processes associated with director candidates nomination.

As per the above policy, the Board of Directors makes decision on the matter concerning the nomination of director (excluding director who serves on the Audit & Supervisory Committee) only after soliciting and considering the opinion of the Nomination & Remuneration Committee.

The Board of Directors makes decision on the matter concerning the nomination of director who serves on the Audit & Supervisory Committee only after soliciting and considering the Nomination & Remuneration Committee’s opinion and gaining approval of the Audit & Supervisory Committee toward the nomination.

Dismissal of a director

The Board of Directors will start proceedings to dismiss any director who displays a lack of ability to perform his or her directorial duties or whom the board otherwise deems has deviated markedly from the above standards.

As per the above policy, the Board of Directors will only propose the dismissal of any director (excluding director serving on the Audit & Supervisory Committee) only after soliciting and considering the opinion of the Nomination & Remuneration Committee.

If the director in question is a non-executive director serving on the Audit & Supervisory Committee, the board must additionally gain approval of the Audit & Supervisory Committee toward the proposal.

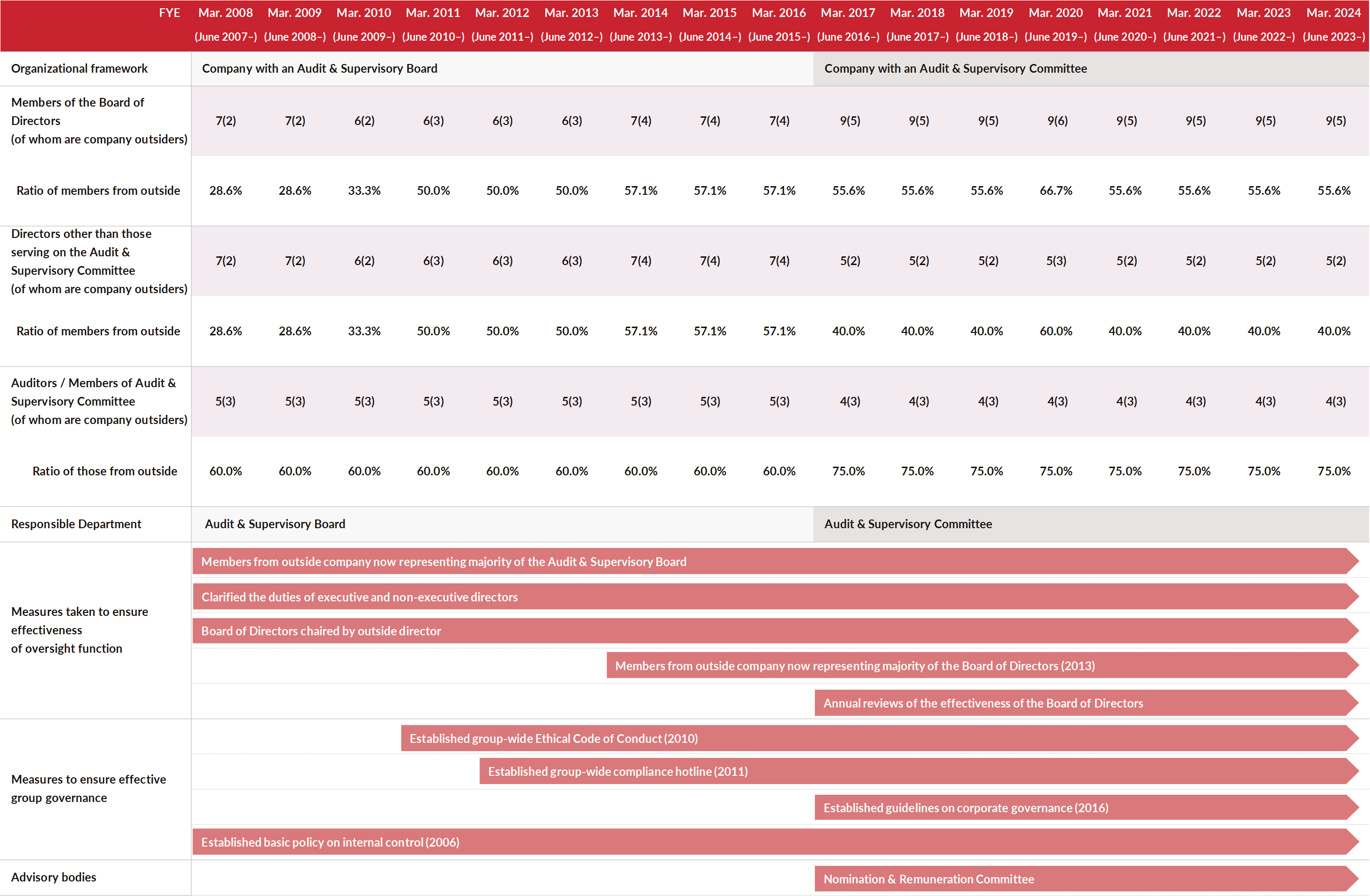

- In June 2016, we switched our corporate structure to the organization with Audit & Supervisory Committee, and streamlined our internal decision-making process by significantly delegating business execution authorities to executive directors. As part of this change, we delegated extensive discretionary authority to executive directors, enabling slicker decision-making and freeing up the Board of Directors to spend more time discussing major strategic issues.

- In 2016, we started publishing corporate governance reports in English.

- In December 2015, we established criteria for determining the “independence” of outside directors and publicized those as an Appendix 1 to the Corporate Governance Guidelines.

- In 2010, Tokai Tokyo Securities started appointing outside directors assuming no post in Tokai Tokyo Financial Holdings.