Investment Banking Division

This division provides services for a wide range of customer needs, including those related to IPOs, public stock offerings, secondary sales, and M&As. For IPOs, the division is expanding its array of sourcing routes by working closer with regional banking partners and with the other two divisions under the trilateral strategy. For straight bonds,it is stepping up marketing for existing municipal and electricity bonds, while engaging more in the underwriting of newly issued bonds it has been slow to develop thus far—namely, corporate bonds and FILP bonds.

Strengths

-

Ability to win orders as lead manager from companies with distinctive business models

-

Ability to build up potential equity holders of IPO firms using a nationwide retail network established together with joint venture securities companies

-

Can source business via regional banking partners and other companies in Tokai Tokyo Financial Group

-

Corporate transaction networks in the Chubu region, collaboration with angel investors in Tokyo

-

Can use group’s venture capital to support and nurture start-up entrepreneurs

Tokai Tokyo Securities’ league table ranking in FYE March 31, 2024

| Ranking |

Bonds overall: |

Municipal bonds: |

Initial public offerings: |

|---|---|---|---|

| Value | ¥300,240 million | ¥145,000 million | ¥5,892 million |

| Share | 1.5% | 4.7% | 1.6% |

| Number of Transactions | 147 (excluding scheduled bonds*) |

41 | 25 |

*Scheduled bonds are public bonds issued periodically on a predetermined schedule

(Created by our company from CAPITAL EYE NEWS)

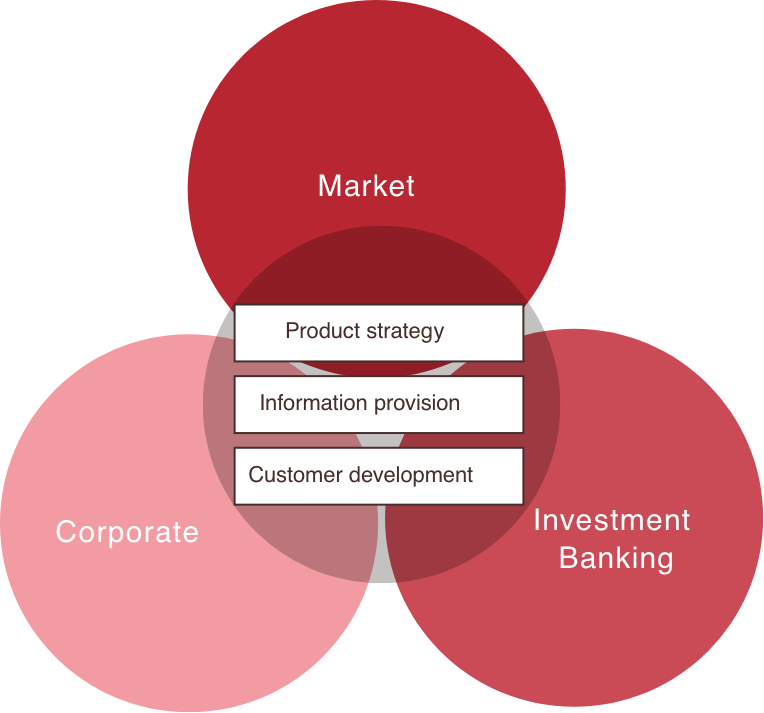

Trilateral initiatives toward corporate customers

In what it calls “trilateral initiatives,” the Tokai Tokyo Financial Group organically integrates the operating resources of market, corporate sales, and Investment Banking Divisions. For corporate customers, we aim to provide a range of options.

We offer, for example, solutions for executing their corporate financial strategies, the personal financial needs of business owners and senior managers, and the asset-building needs of employees in these companies.

Strategies

- The divisions collaborate with each other in the areas of product origination, such as M&A intermediation, underwriting, and corporate sales, in order to deliver high-quality financial solutions to corporate customers

- The three divisions create synergy to provide customers with further services and to expand business opportunities