Retail Division

Tokai Tokyo Securities follows a segmented retail strategy, tailoring its products and services to the needs and attributes of three segments: high-net-worth, matured, and next-generation asset forming. Recently, the Company started boosting the productivity of its retail operations. Specifically, in view of the progress in Japan’s workstyle reform agenda along with the Covid-driven changes to working practices, the Company started reorganizing its sales offices to streamline its customer-facing facilities and enable a more dynamic approach to customer engagement.

Strengths

-

Overwhelming presence in Chubu region

-

Strong ties with local customers, winning trust from them

-

Can work with affiliates to meet a wide range of customer needs

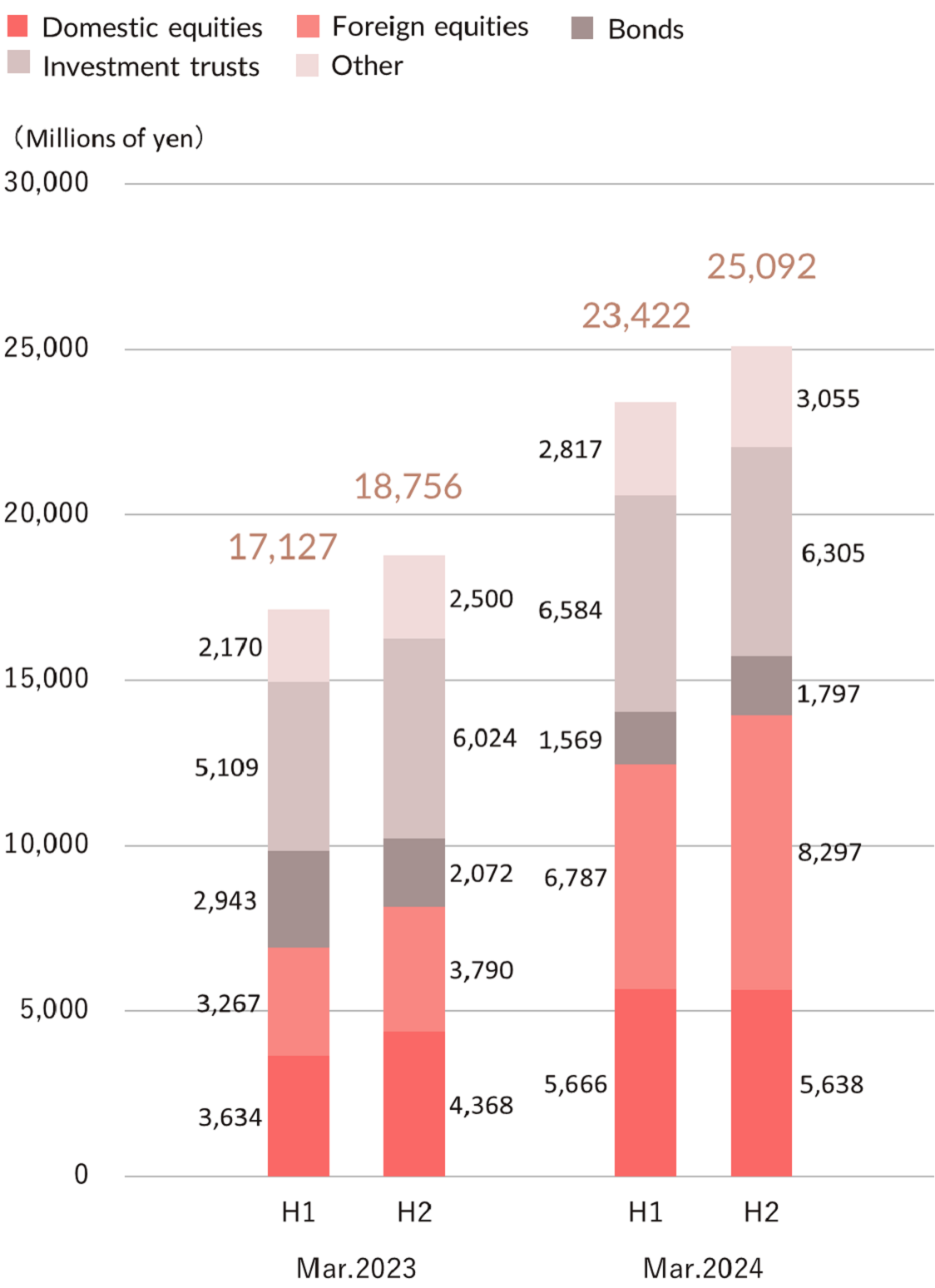

Revenue by product category

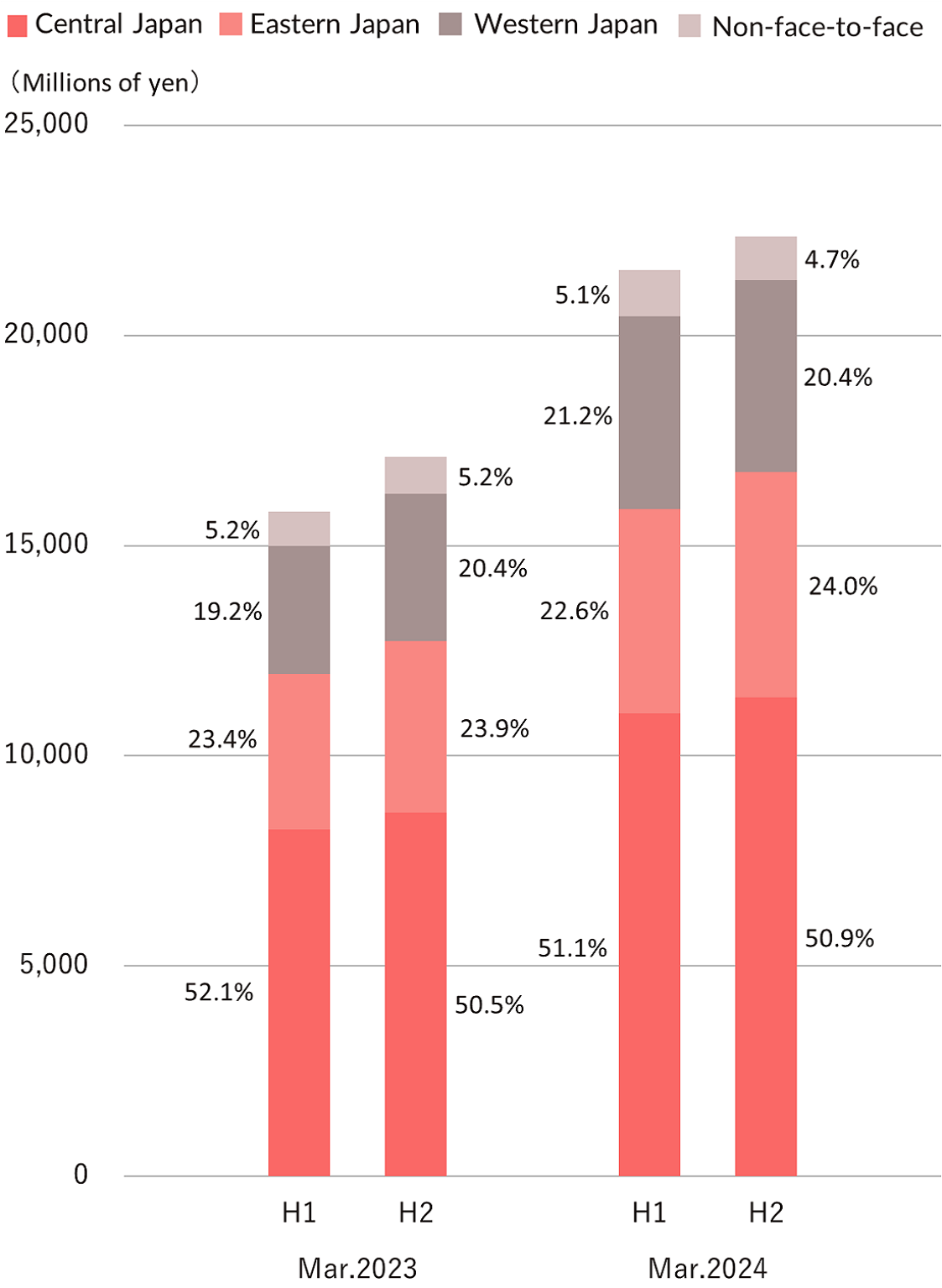

Revenue by geographical region

Note 2: Excludes revenue that was not generated from transactions with customers

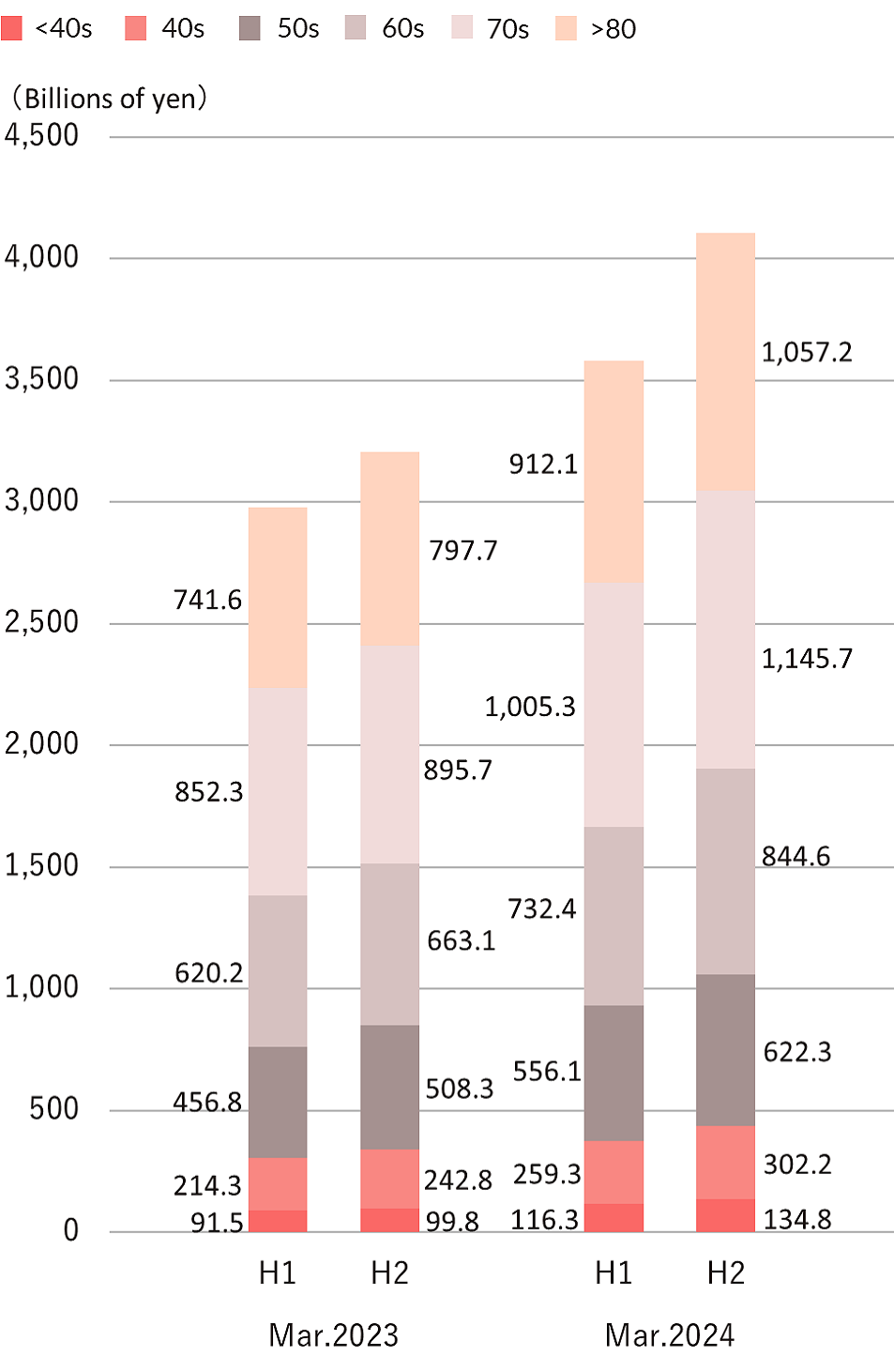

Assets under custody by age group of customers (period end)

Note 2: Other than these age categories, Tokai Tokyo Securities holds the assets for corporate customers as part of its retail operations

Segment-specific retail strategy

High-net-worth segment

Further enhancement of Orque d'or functions and services and development of Tokai Tokyo Wealth Consulting Co., Ltd.

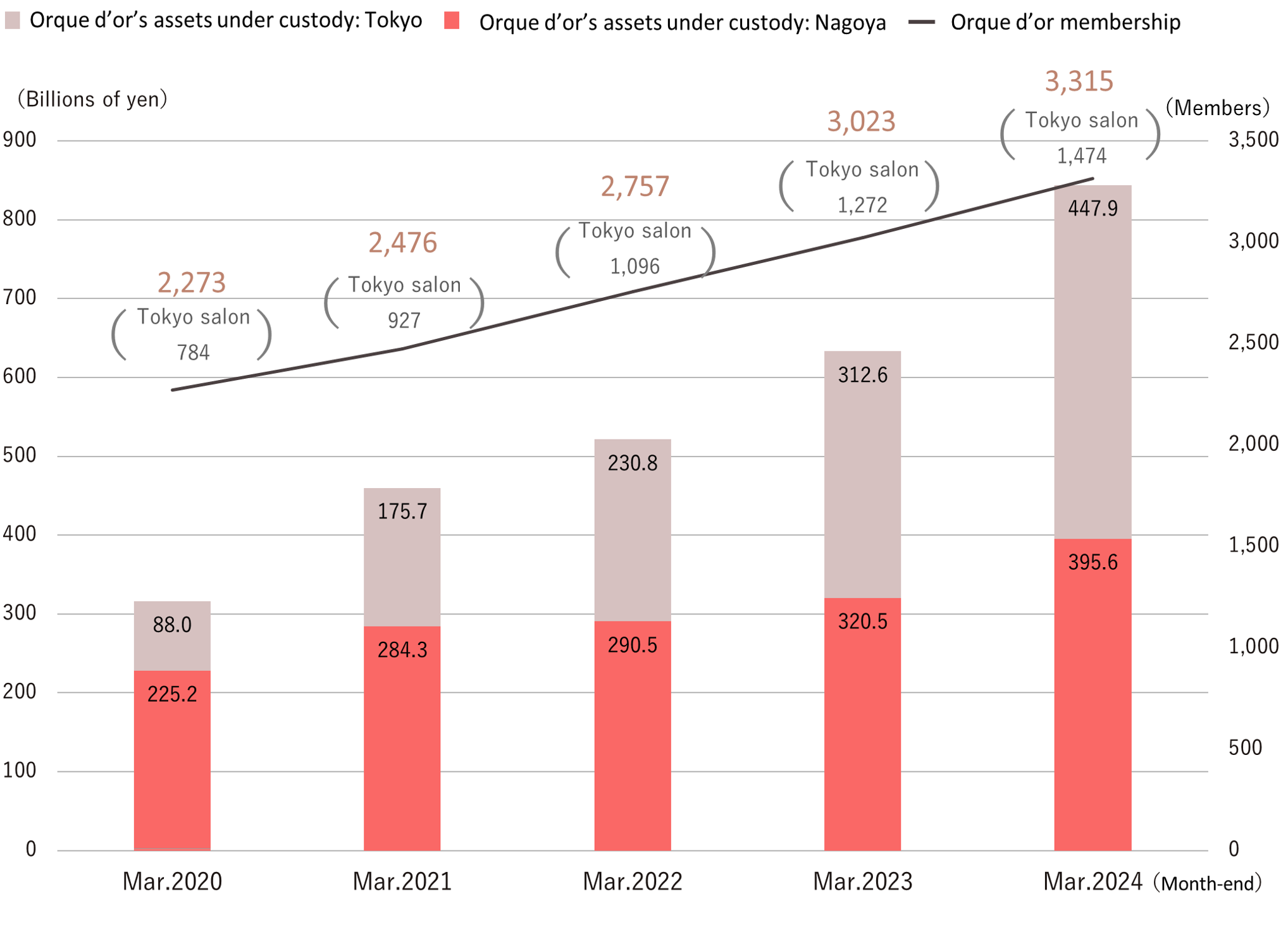

In November 2015, Tokai Tokyo Securities launched Orque d’or as a service brand dedicated to the high-net-worth segment. Orque d’or has a team of experts devoted to offering the premium services to this segment. For business owners, medical practitioners and others in this segment, Orque d’or offers services in two broad categories. The first is “business support,” which advises such customers on how to manage their capital and companies' own stocks. The other is “total management,” which offers advice on their asset and health management. Orque d’or offers total solutions covering financial matters as well as those not related directly to finance, such as inheritance, business succession, and more. Popular among members are for members’ only “Orque d’or’s Salon” (Nagoya) and “Orque d’or Salon TOKYO” (Nihonbashi, Tokyo). Here, members enjoy luxurious amenities in a refined space.

A subsidiary of the Company, Tokai Tokyo Wealth Consulting Co., Ltd. that provides consulting services to the wealthy, provides high-quality solutions for inheritance and business succession measures and real estate brokerage projects, etc. in cooperation with a network of specialists.

Orque d’or’smembers-only salons

Orque d’or’smembers-only salons

Opened on the top floor of Dainagoya Building in March 2016. The salon includes facilities such as a lounge, restaurant, reception, seminar room, multipurpose hall, and a Japanese style annex.

Opened on the top floor of Nihonbashi Takashimaya Mitsui Building in April 2019. The salon boasts a lounge, restaurant, reception, seminar room, multipurpose hall, and a rooftop garden.

Orque d’or membership and the members’ assets under custody

Matured segment

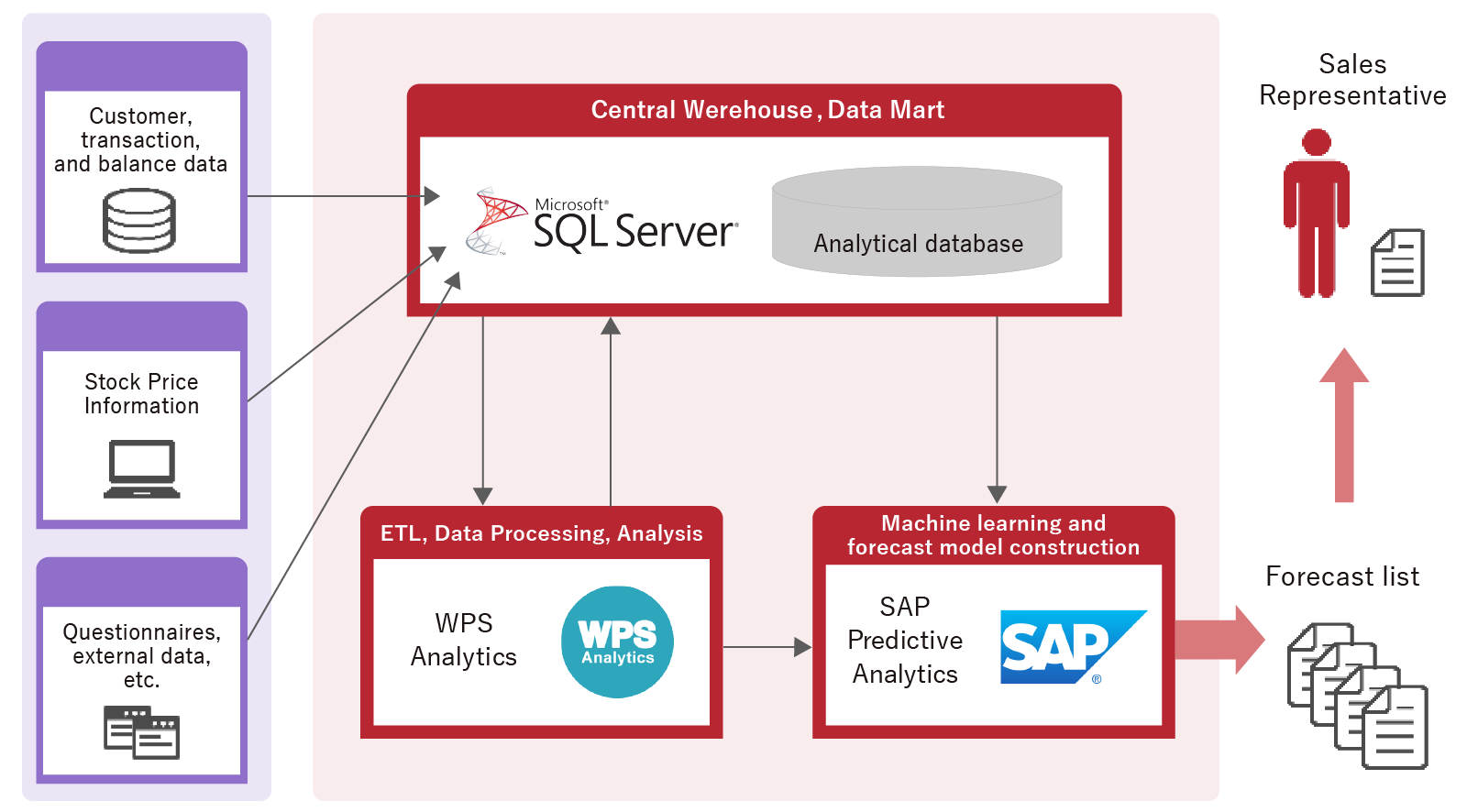

Customer development through corporate and individual sales, database marketing, and utilization of integrated customer assets management system

Centered on consulting services related to life events in customers, we utilize asset assessment services to propose various financial products and solutions. Other examples of the varying services for this segment include special accounts for customers with a high risk appetite and integrated services for owners of small to medium sized businesses (SME) and retail customers. By deepening digitalization, we have introduced an integrated management system (MILIZE) that uses AI to manage database marketing, financial assets, real estate, and insurances, etc. and are working to improve customer service.

MILIZE

Provision of various simulations from the life plan

(Robo-ad portfolio, portfolio replacement, future simulation, etc.)

Next-generation asset forming segment

Available services:“Okane no Compass for TT,” “MONEQUE,” “ETERNAL” and “Mebius”

This segment targets customers aged 20–49 and constitutes one of the Group’s core next-generation businesses. Accordingly,

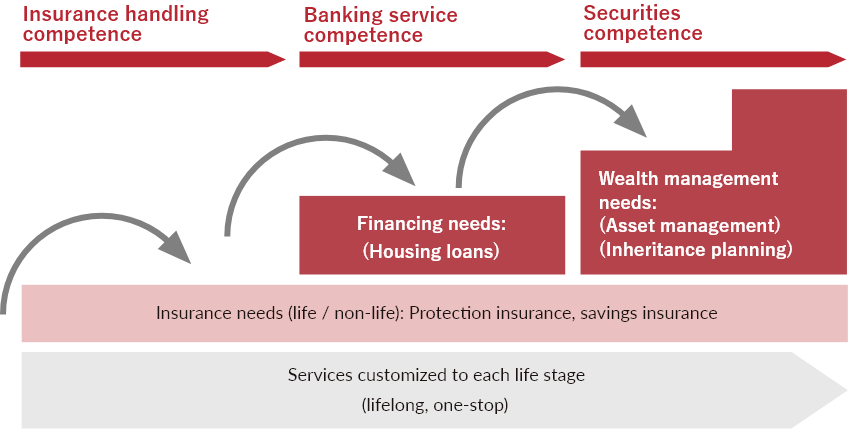

we are developing more products and services in this segment and expand further its customer base. In addition to developing MONEQUE stores, which offer one stop financial services tailored to the life stages of the assets formation, we are also actively engaged in activities to raise awareness of assets formation through promotion of job-based sales in Chubu region, our mother market. We also offer “Okane no Compass for TT”, a smartphone application that enables users to use various financial services suitable for the assets formation layer, including assets management, investment, insurances and pension services. The Company also provides services through its subsidiaries “ETERNAL Co., Ltd.”, which operates “Hoken Terrace”, a shop based insurance agency, and “Mebius Co., Ltd.”, a telemarketing insurance agency.

MONEQUE: A one-stop channel targeting next-generation asset forming customers

Job-based Seminar